Tuesday, December 9, 2008

True Intolerance

The fact is, the one area where it is still acceptable to vent intolerance is when it comes to discussing Christians. They are called ignorant, they are called hateful, they are said to be against scientific progress, and their belief in Biblical inerrancy is called a relic of the past. These same people then turn around and proclaim the need for universal tolerance.

Rather than spend time venting myself on this hypocrisy, I will instead focus on the recent bit of Christian bashing in the recent Newsweek cover story, entitled The Religious Case for Gay Marriage. From what I can tell, the article has essentially four premises:

1) The Bible is ambiguous on the morality of same-sex relationships.

2) The Bible is so littered with bizarre rules and horrid tales that its teachings should be ignored anyway.

3) The Bible was written for a different culture, and is therefore not directly applicable (my translation: the Bible is irrelevant).

4) Because slavery was eventually outlawed, segregation ended, and women's rights were won, and because some opinion polls show that younger people are more open to legalizing gay marriage, it must be the case that gay marriage is the right way to go and anybody standing against it is merely resisting the inevitable course of history.

It is beyond me how an article which essentially bashes the Bible can claim to be making a religious case for gay marriage. Even beyond that, Lisa Miller is clearly ignorant when it comes to Biblical teachings. Rather than go into each and every point where she goes wrong, I will send you here.

In response to the outcry over his magazine's piece, Jon Meacham writes the following:

"Given the history of the making of the Scriptures and the millennia of critical attention scholars and others have given to the stories and injunctions that come to us in the Hebrew Bible and the Christian New Testament, to argue that something is so because it is in the Bible is more than intellectually bankrupt—it is unserious, and unworthy of the great Judeo-Christian tradition."

In other words, to argue that the Bible contains the ultimate truth, and that therefore what it says is correct, is unserious and unworthy of the great Judeo-Christian tradition. I ask again: how can you have a Judeo-Christian tradition that is not based on the Christian truths of the Bible?

Lastly, I will point you to a short musical made by the enlightened ones in Hollywood against Proposition 8 where they, you guessed it, made Bible believers look like intolerant, uneducated, closed-minded dupes and where Jesus himself criticizes the Bible and seems to endorse gay marriage. How strange.

For more reaction to this video, go here.

If you are interested in knowing the truth about what the Bible says about homosexuality, you should watch this video with Dr. Robert Gagnon:

Dr. Robert Gagnon, What Does the Bible Teach About Homosexuality? S3E2 from Pure Passion on Vimeo.

Addendum: I am sure that some people who read this will conclude that I am against gay marriage based on Biblical grounds, and that my main reason for posting this was to defend that view. This is not true. I do believe that the Bible is unambiguous on the immorality of same-sex relationships, but that is not why I oppose legalizing them. After all, I believe the Bible is unambiguous on the immorality of adultery, but I do not favor having the government enforce marriage fidelity.

To the contrary, I oppose same-sex marriage for two main reasons.

1) There is no Natural Law or biological purpose for same-sex relationships. Heterosexual unions are the only unions that can naturally bring about new generations. Like it or not, we live in a world where babies result from one man and one woman. As a result, I believe that these relationships serve a vital purpose that no other relationship can serve as fully.

2) If you believe that the only important thing about marriage is that the people love each other (I believe marriage is much bigger than that), then you probably support gay marriage. After all, why should we stop two people from acting on their love for each other? However, if you truly believe that our current laws are discriminatory, why not take that to its inevitable conclusion? Are ANY limits on the definition of marriage between consenting adults justified? Should we legalize polygamy, marriage between relatives, and group marriages? Most honest people, including those who honestly support gay marriage, will answer this question in the negative.

I have many more thoughts on this issue, but alas, I do have other things to do, you know! If anybody has comments, questions, or thoughts, I would like to hear them and I will respond.

Sunday, December 7, 2008

What To Do About The Auto Industry

Congress has been responding to this by demanding that the Big 3 draw up plans for their viability and present them before Congress. This approach is ridiculous. Congress has no ability whatsoever to judge how likely the business plans are to succeed. Having Senator Dodd or Barney Frank put their stamp of approval on GM's business plan says absolutely nothing about how the market will value the companies' products and business strategies.

Another problem with the potential bail-out is the precedent it sets. What distinguishes the auto industry from any other major US industry (aside from its inability to be competitive)? What if the pharmaceutical industry knocks on Congress' door, or large energy companies, or agribusiness? Will Congress expect all of them to draw up business plans for Congress to evaluate? The whole notion is patently absurd.

My preferred approach is to let the marketplace decide the fate of the auto companies, just as it does all other companies. In the meantime, the government should focus on helping out the workers themselves who would be potentially affected by a bankruptcy. These workers should not get any more insurance or protection than workers at other US companies, nor should they receive less. I do not doubt that a bankruptcy would have some negative short-term consequences for the US macroeconomy, but that is no different than any other major loss of jobs. If we start meddling in the economy to prevent companies from failing, in the long-run all we will really end up doing is to ensure that fewer companies end up truly succeeding. That is a consequence we should all hope to avoid.

Thursday, December 4, 2008

Monday, December 1, 2008

The Future of Free Market Conservatism

Tuesday, November 25, 2008

What About That $2,500?

Saturday, November 22, 2008

The Rich and Their Fair Share

See the graph here.

Friday, November 21, 2008

Should We Bailout US Automakers?

On the other hand, the automakers can claim no such thing. The US government has not compelled GM, Ford, and Chrysler to produce products that Americans do not buy, or to load themselves up with obligations to both current workers and retirees that they cannot afford. I am therefore firmly against any bailout for automakers. Furthermore, I find the notion of GM, Ford, and Chrysler submitting business plans for Congress to analyze (and to supposedly affirm the viability of the automakers) absurd. The only true test of success of a business plan is how the business survives in the marketplace.

Harvard economist Ed Glaesar discusses this issue at more length here.

Tuesday, November 18, 2008

The Human Cost of Recessions

Losing an income or a sense of economic security during an economic downturn (either a national or a personal one) is painful. Losing ties to your community and becoming socially and psychologically isolated is much worse.

Wednesday, November 12, 2008

Equality Under the Law vs Equality of Outcomes

"Equality under the law means that all citizens are protected by the government from the initiation of force against themselves and their property. Equality of outcomes means that the government may actively use force to balance out differences between others.

Equality under the law means that men should be judged not by the color of their skin but by the content of their character. Equality of outcomes means that skin color can be a prime factor in distinguishing between individuals.

Equality under the law is about equal rights, meaning the protections that ensure an individual’s liberty and security. Equality of outcomes perverts the notion of rights to give some citizens a claim on the rights of others.

Despite being backed by “good intentions”, equality of outcomes is as much a threat American liberty as enforced segregation or hereditary aristocracy. All of these ideas suffer from the same vice – they fail to administer identical standards of justice to all citizens.

Equality under the law does not endorse wide divergences in social conditions. It does not support a growing gap between rich and poor. In fact, valuing equality under the law is often one of the best means of closing such gaps, precisely because attempts to mandate equality of outcomes often end up being counter-productive and hurting the people they intend to help. The point, however, is that equality under the law is not designed to guarantee economic and political conditions but rather to protect economic and political freedoms. It recognizes that human beings are different and that objective standards must therefore allow for different results amongst them. Equality under the law ultimately means that all citizens are treated with respect and dignity as free individuals with equal rights."

Monday, November 10, 2008

12% Unemployment?!

Sunday, November 9, 2008

An Obama Mandate?

The truth is that people do not vote en masse based on ideologies. Most people do not even have a political ideology, let alone vote based on one. People vote based on how well they think each candidate addresses the concerns that they and their peers have for the country, and how well those solutions presented comport with their sensibilities.

Even ignoring Obama's political acumen, it is clear from the past 2 years that conservatives have failed to even address in any serious manner some of the major concerns that Americans are having-- rising college and healthcare costs, a polarization of incomes coupled with stagnating middle incomes, and diminishing job security. When conservatives do not sit at the table for the discussion, then the opposition wins the argument by default. The only way we are guaranteed to enter into an era of progressive hegemony is if conservatives insist on no more than buckling down and being more pure versions of their 1980's selves while ignoring the concerns of the people who actually vote.

Rich Lowry discusses this in more detail. It is a very insightful article. To read, go here.

Mark Steyn is Less Optimistic

"If you went back to the end of the 19th century and suggested to, say, William McKinley that one day Americans would find themselves choosing between a candidate promising to guarantee your mortgage and a candidate promising to give "tax cuts" to millions of people who pay no taxes he would scoff at you for concocting some patently absurd H.G. Wells dystopian fantasy. Yet it happened. Slowly, remorselessly, government metastasized to the point where it now seems entirely normal for Peggy Joseph of Sarasota, Fla., to vote for Obama because "I won't have to worry about putting gas in my car. I won't have to worry about paying my mortgage."

While few electorates consciously choose to leap left, a couple more steps every election, and eventually societies reach a tipping point. In much of the West, it's government health care. It changes the relationship between state and citizen into something closer to pusher and junkie. Henceforth, elections are fought over which party is proposing the shiniest government bauble: If you think President-elect Obama's promise of federally subsidized day care was a relatively peripheral part of his platform, in Canada in the election before last it was the dominant issue. Yet America may be approaching its tipping point even more directly. In political terms, the message of the gazillion-dollar bipartisan bailout was a simple one: "Individual responsibility" and "self-reliance" are for chumps. If Goldman Sachs and AIG and Bear Stearns are getting government checks to "stay in their homes" (and boardrooms, and luxury corporate retreats), why shouldn't Peggy Joseph?

I don't need Barack Obama's help to "spread the wealth around." I spread my wealth around every time I hire somebody, expand my business, or just go to the general store and buy a quart of milk and loaf of bread. As far as I know, only one bloated plutocrat declines to spread his wealth around, and that's Scrooge McDuck, whose principal activity in Disney cartoons was getting into his little bulldozer and plowing back and forth over a mountain of warehoused gold and silver coins. Don't know where he is these days. On the board at Halliburton, no doubt. But most of the beleaguered band of American capitalists do not warehouse their wealth in McDuck fashion. It's not a choice between hoarding and spreading, but a choice between who spreads it best: an individual free to make his own decisions about investment and spending, or Barney Frank. I don't find that a difficult question to answer. More to the point, put Barney & Co. in charge of the spreading, and there'll be a lot less to spread.

I disagree with my fellow conservatives who think the Obama-Pelosi-Reid-Frank liberal behemoth will so obviously screw up that they'll be routed in two or four years' time. The president-elect's so-called "tax cut" will absolve 48 percent of Americans from paying any federal income tax at all, while those who are left will pay more. Just under half the population will be, as Daniel Henninger pointed out in The Wall Street Journal, on the dole.

By 2012, it will be more than half on the dole, and this will be an electorate where the majority of the electorate will be able to vote itself more lollipops from the minority of their compatriots still dumb enough to prioritize self-reliance, dynamism and innovation over the sedating cocoon of the Nanny State. That is the death of the American idea – which, after all, began as an economic argument: "No taxation without representation" is a great rallying cry. "No representation without taxation" has less mass appeal. For how do you tell an electorate living high off the entitlement hog that it's unsustainable, and you've got to give some of it back?""

An Economic Perspective from FedEx

"Fred Smith is in an agitated state. He's just returned from a Washington Redskins game -- played in FedEx field in Washington -- and the team has been upset by the St. Louis Rams. "It was just awful," he grouses. "My son's one of the coaches, and he was ready to jump off the ledge of the stadium."

There are few better people to ask about our current economic precipice than Mr. Smith -- or, as some people call him, "Fred Ex." His company has $38 billion in sales, employs four football stadiums full of workers, owns 300 jet airplanes, and tens of thousands of trucks and vehicles. FedEx moves an incomprehensible seven million packages each day to every corner of the globe. And the good news is that Fred is optimistic -- sort of.

Ismael Roldan

"Oh, the country is going to get through this and the financial markets will stabilize," he assures me, but only after we go through a period of "trauma and readjustment."

I ask him just what he means by "trauma." He attributes the financial crisis to "the intersection of four long-term developments." Reckless mortgage lending policies; high energy prices; mark-to-market accounting rules; and national policies that favor what he calls "the financial sector over the industrial sector."

"Rather than in our business where you have to have a dollar of equity for, 10 cents or 15 cents of debt," he explains, "it's exactly the opposite in the financial sector where you have one dollar of equity for 10, 25, 50 times risk." "Things became so flipped upside down," he explains, that "the assets at these banks became the liabilities and the liabilities became the assets. These people were making these fantastic returns -- at places like Fannie Mae and Freddie Mac -- but in reality they weren't adding a lot of value. I have said time and again that there is a fundamental tendency in good times in the financial sector to over-leverage. Our national policies actively encouraged all this debt."

How so? "The United States has a completely uncompetitive tax structure in general and it has a particularly onerous tax structure for firms that are asset-intensive. If you run an industrial company like FedEx, which employs 290,000 folks, most of whom are blue-collar people, the way we have to run this business is to equip those workers with billions of dollars of assets that allow them to pick up and deliver millions of things around the world."

His theory is that the tax bias against capital explains why so much top U.S. talent got whisked off to become investment bankers. "Not too many young people coming out of school are studying to be production managers at General Motors." He says that most of FedEx's first line managers come not from the top flight universities, but out of community colleges and the military. "The top talent has wanted to go to Wall Street."

He has come to hold the get-rich-quick Wall Street financiers in more than a little disdain. He views the heroes of the U.S. economy as the companies that actually produce real goods and services. He sees the Wall Street collapse as an inevitable byproduct of investment bankers building multitrillion dollar debt pyramid structures.

So how do we fix this problem and retool our industrial sector in a pro-competitive fashion? "We've got to reduce the taxes on equity. Let companies expense their capital purchases."

He uses an example from FedEx. "Look, our capital budget as we went into this year was about $3 billion. We went out to Boeing in July for our board meeting to see the new triple seven, [the Boeing 777] which we have bought. If we had a lower corporate tax rate with the ability to expense capital expenditures, guess what? We'd buy more triple sevens. We absolutely have to cut the corporate tax. Our current tax rate is about 38%. Even Germany has a 25% rate."

We turn to the election. Mr. Smith is one of the most enthusiastic supporters of John McCain among the Fortune 50 CEOs. When I ask why, he says instantly: "Because I agree with him on trade, taxes, energy and health care."

Next I ask Mr. Smith about the class warfare theme of the political debate. "The politicians deplore the fact that we have a disparity of income," he says, but "the only way to make a blue-collar person earn more is to invest in capital, training and infrastructure. So the more you tax capital, the more you hurt workers." He estimates that about 70% of the return from FedEx capital expenditures is captured by workers in the form of higher wages as their productivity rises.

He sees a big problem in that so few Americans now pay any income tax. "We're now at a point where a very large part of the population pays no federal income tax at all. When you have a majority of the population that realizes that you can transfer money from the productive to themselves, that's one of the great questions for the future of civilization, as far as I'm concerned."

As for CEO pay, Mr. Smith concedes that in some cases corporate management pay scales have gotten far out of line with shareholder interests. But he is quick to add: "I don't think anybody begrudges somebody making a large amount of money as long as it benefits everyone else. The problem is when they make a large amount of money and the shareholders get clobbered." As he sees it, "There's only one solution, and that is for a competent board of directors to oversee managers and give them incentives which are long-term in nature and which are irrevocably tied to the fortunes of the shareholders."

I tour the FedEx command and control center outside the Memphis airport. It's an awesome sight. FedEx operates its own air traffic control system and its own weather monitoring services. It takes over whole airports at night, and it operates its own risk mitigation operation to prepare for every possible contingency. "We have to know instantly how we reroute our planes if that storm in Tulsa turns into a tornado," the operations manager explains. There's a massive screen covering an entire wall that monitors the location and progress of every FedEx plane in the sky.

The computer technicians show me a jaw-dropping display on the computer screen of a fast-motion day of FedEx plane travel. Starting in the wee hours of the morning, the planes descend from all over the country into the Memphis airport. A few hours later, after being loaded with packages, the jets begin their assault on the major cities of the nation and world. They call this the "ant farm," because it resembles armies of ants scurrying to every corner of the globe. This is a company that has staked its entire reputation on getting packages to their appointed destination, "absolutely, positively overnight."

I keep thinking how many tens of billions of dollars Uncle Sam would save if it were one-third this efficient. These are the people that should have been in charge of the rescue operation during Hurricane Katrina. "We got all our people out -- no problem," Mr. Smith tells me.

Considering FedEx's world-wide operations, and its rapid expansion in China, it occurs to me that there is perhaps no other company in the world more dependent on international trade. Sure enough, Fred Smith is a fanatical supporter of free trade. So much so that he says, "I think the best thing the United States could do is to unilaterally disarm. It should open up markets. The agricultural subsidies are terrible. They're just immoral."

On economic grounds, he continues, "I think the history is very clear, that trade is the main reason that the world has enjoyed the prosperity. Look at China. They've drug hundreds of millions of people out of poverty through trade."

Trade aside, no issue is of greater consequence to FedEx than energy policy. FedEx consumes 1.3 billion gallons of jet fuel a year, and is the largest user of energy in the world next to the U.S. military. Mr. Smith sits on the board of the Energy Security Leadership Council, which issued a report a few months ago advocating a huge expansion of domestic energy supply. How do we do this?

"Two things," he insists. "The first is we should maximize oil production in the United States in every respect. Everything, offshore, Alaska, shale, nonconventional, coal to liquid, gas to liquid, and nuclear. Let the market work.

"Second, and this is where I am an apostate on the free market, and also where I disagree in the main with, with Boone Pickens," Mr. Smith adds. "The United States has only one real way to reduce our dependence on foreign petroleum, in terms of reducing demand while we're increasing our domestic supply, and that is to electrify the short haul transportation system, to go to battery powered cars. The technology that brought us laptops and cell phones has reached a point where these lithium ion batteries can now produce cars like the Chevy Volt and the new plug-in Toyota Prius." Many FedEx trucks are already using this technology, though he admits they aren't yet cost efficient but are 42% more fuel efficient.

Mr. Smith ends our interview with a little sermon about what the U.S. must do to retain its global economic superpower status. "Many of our current policies are not conducive to continued economic leadership. We restrict immigration when we have thousands of highly educated people that want to come to the United States, and some of our greatest corporations [are] crying out that we don't have the scientific talent that we need to develop the next generation of innovations and inventions . . .

"That's where all wealth comes from . . . It's not from the government. It's from invention and entrepreneurship and innovation. And our policies promote a legal and regulatory system which impedes our ability to grow entrepreneurship. Lastly, if we want to make [America's workers] wealthier we have to quit demonizing quote, big corporations."

As I walk out the door I ask Mr. Smith if he's communicated these ideas directly to Barack Obama. "I haven't met Barack Obama," he replies. "He's certainly a charismatic fellow and well-spoken. I just disagree with him on trade and taxes and energy and health care.""

Friday, November 7, 2008

Thursday, November 6, 2008

The Danger of Taxes That Are...Too Low?

"Both Obama and McCain have a tendency to see villainy as an explanation for our economic woes. Obama thinks opposing tax increases is unneighborly and selfish. McCain has a long habit of denouncing Wall Street “greed.”One moral hazard of such attitudes is that the investor class will start applying its entrepreneurial skills to protecting its existing wealth from the tax collector rather than trying to create more wealth.But the greater danger is that millions of Americans might believe that all that is keeping them from the good life is the tightfistedness of people doing better than them and a government unwilling to pry those wealthy fingers open. That’s a recipe for an unhealthy political culture.A sane tax code, under any president, would be simple, clear and direct. We’re not going to give up on redistribution in the form of, say, the earned income tax credit. But it’s important that the working and middle classes feel as if government spending comes out of their wallets, too. Otherwise, the line between citizen and subject is blurred and the costs of government are seen as someone else’s problem."

The Danger of Taxes That Are...Too Low?

Avoiding a Return to Paternalism

"Particular emergencies require energetic government, and there are times when people need a helping hand. President-elect Obama’s challenge will be to find ways to give people that helping hand without raising up massive and all but ineradicable bureaucracies that degrade the human spirit by taking away from citizens decisions they must make for themselves, and by insulating them from the consequences of their actions.It won’t be easy. When times are hard it is tempting to imagine that supervisory agencies with wide discretionary powers can solve our problems for us and deliver, deus ex machina, the prosperity we seek. In the long run, however, it is the initiative of free people that solves problems and improves the quality of life. Exaggerated rhetoric about the failure of free markets should not be permitted to obscure that basic truth. Freedom works because it liberates the human spirit and removes barriers to achievement. Paternalism doesn’t work because over time it turns too many citizens into helpless wards of the state — a sub-caste permanently unequal to the challenge of life — and puts obstacles in the way of other citizens whose productive energies are taxed in order to pay for the chandala class’s upkeep.If he is to succeed in the White House, President-Elect Obama needs to promote, through his policies, the principle of equality his own election so signally confirmed. He must find a way to address the current discontents without returning to paternalist policies that will jeopardize an ideal of which he himself is one of history’s most striking embodiments."

The Vanishing Republican Voter

What Conservatives Should Do

"What should the GOP, and the conservative movement more generally, be concentrating on for the next few years? Developing, demonstrating, and communicating solutions to the current problems of the middle class.

Most conservatives who propose a return to "Reagan conservatism" don't understand either the motivations or structure of the Reagan economic revolution. The 1970s were a period of economic crisis for America as it emerged from global supremacy to a new world of real economic competition. The Reagan economic strategy for meeting this challenge was sound money plus deregulation, broadly defined. It succeeded, but it exacerbated a number of pre-existing trends that began or accelerated in the '70s that tended to increase inequality.

International competition is now vastly more severe than it was 30 years ago. The economic rise of the Asian heartland is the fundamental geostrategic fact of the current era. In aggregate, America is rich and economically successful but increasingly unequal, with a stagnating middle class. If we give up the market-based reforms that allow us to prosper, we will lose by eventually allowing international competitors to defeat us. But if we let inequality grow unchecked, we will lose by eventually hollowing out the middle class and threatening social cohesion. This rock-and-a-hard-place problem, not some happy talk about the end of history, is what "globalization" means for the United States.

Seen in this light, the challenge in front of conservatives is clear: How do we continue to increase the market orientation of the American economy while helping more Americans to participate in it more equally?

Here are two ideas among many.First, improve K-12 schools. U.S. public schools are in desperate need of improvement and have been for decades. We do not prepare the average American child to succeed versus international competition. Schools can do only so much to fix this—in a nation where 37 percent of births are out-of-wedlock, many children will be left behind—but it would be a great start if the average school didn't go out of its way to make kids lazy and stupid.

No amount of money or number of "programs" will create anything more than marginal improvements, because public schools are organized to serve teachers and administrators rather than students and families. We need, at least initially, competition for students among public schools in which funding moves with students and in which schools are far freer to change how they operate. As we have seen in the private economy, only markets will force the unpleasant restructuring necessary to unleash potential. Conservatives have long had this goal but are unprepared to win the fight. Achieving it would be at least a decade-long project.

The role of the federal government could be limited but crucial. Suppose it established a comprehensive national exam by grade level to be administered by all schools and universities that receive any federal money and required each school to publish all results, along with other detailed data about school budgets, performance, and so forth each year. Secondary, profit-driven information providers, analogous to credit-rating agencies and equity analysts, would arise to inform decision-making. The federal role would be very much like that of the Securities and Exchange Commission for equity markets: to ensure that each school published accurate, timely, and detailed data. This would not only improve schools in the aggregate but also serve to provide a more realistic path of economic advancement to anybody with a reasonably responsible family and help to acculturate more Americans to a market economy. This would also become a model for other reform of entitlement programs, from retirement accounts to medial care.

Second, reconsider immigration policy. What if, once we had control of our southern border, we came to view the goal of immigration policy as recruiting instead of law enforcement? Once we established a target number of immigrants per year, we could set up recruiting offices looking for the best possible talent everywhere from Beijing to Helsinki. It would be great for America as a whole to have, say, 500,000 very smart, motivated people move here each year with the intention of becoming citizens. It would also do wonders for equality if they were not almost all desperately poor, unskilled, and competing with already low-wage workers.

Other examples of policies that can raise competitiveness and lower inequality, ranging from reduced small-business regulation to allowing individuals tax deductibility for private health care purchases to automatic (with an opt-out) enrollment for 401(k) plans, become obvious once you start to look for them. What they tend to have in common is a focus on building human capital and effective market institutions. That is, they build the key resources of the new economy.

The conservative movement has become excessively dogmatic and detached from realities on the ground. It needs to become more empirical and practical—which strike me as traditionally conservative attitudes."

Wednesday, November 5, 2008

A Prayer for Obama

Our prayer today, Our Father, is for President-Elect Barack Obama.

Our prayers include:

That You, the infinite font of wisdom, might grant him wisdom daily.

That You, the loving God of all, might grant him love for you and for others, including our enemies.

That You, the holy and righteous God of justice, might empower him to do what is right in all that he does.

That You, the Lord, might grant him the charisma of insight to lead in this turbulent world and time.

That You, the Healer, might grant him the grace of reconciling damaged relations in this country and in the world about us.

That You, the God of Life, might grant him a commitment to act for all -- the unborn and born, the young and old, the civilian and the soldier -- to preserve life and honor that each of us is fashioned in the image of God.

That You, the Father, might grant him the time and wisdom to father his two young daughters and love Michelle, his wife.

And that You, the God of all comfort, might grace him and his family as they mourn the loss of his grandmother.

Lord, hear our prayer.

Through Christ our Lord, who lives and reigns with you and the Holy Spirit, one God, forever and ever. Amen.

Change We Actually Can Believe In

"After a long, hard fought and history-making campaign, Barack Obama is the president-elect. There is great joy throughout America and the world at the election of this thoughtful man as our first black president. Now that the grinding political process is behind us, he is free to reshape his campaign sound bites into presidential policies that will deliver the real change he promised.

And here, I start to dream…

In a bold departure from campaign rhetoric aimed at comforting disaffected rust-belt voters, Mr. Obama is now able to affirm his commitment to free trade and the process of globalization. Importantly, informed by his University of Chicago and Harvard-based economic advisers, he has underscored his support for the North American Free Trade Agreement, to the great relief of our most important trade partners to the North and the South.

In backing away from his threat to unilaterally back out of NAFTA, Mr. Obama is citing the fact that the overall value of trade between the U.S., Canada and Mexico has more than tripled to $930 billion in the years since the Treaty was put into place. Trade with NAFTA partners now accounts for more than 80% of Canadian and Mexican trade, and more than a third of U.S. trade.

More importantly, he notes that all of the evidence suggests that U.S., Mexican, and Canadian gross domestic products have grown as a result of the NAFTA Treaty. Mr. Obama points out that real hourly compensation in the U.S. business sector has risen 19.3% over the period from 1993-2007, suggesting that NAFTA may not have suppressed U.S. wages as alleged by its critics.

To further underscore his commitment to free trade and take a swipe at the special interest politics of the past, Mr. Obama has moved aggressively to remove absurdly costly protections for ethanol production and opened the door to ethanol imports from emerging markets like Brazil. And the American people, relieved to have real leadership at last, are easily convinced that removing huge subsidies to corn growers in the U.S. will help ease the distortions in the worldwide market for basic food stuffs.

Given the profound weakness in the economy, Mr. Obama has backed away from his promises to increase taxes on the returns on human capital (his redistributive tax on the top 2% of earners), and on physical capital (capital gains, dividends and corporate profits). He recognizes that what we need is more investment in all these forms of capital to stimulate the economy, and that private investment is the best way to achieve it.

Indeed, recognizing that the key to the future prosperity of the U.S. economy is--as it has always been--rising productivity driven by innovation, Mr. Obama has announced new immigration policies that will open America's doors to talented workers to meet the needs of American companies--something that Bill Gates and other great innovators have been urging for many years.

This courageous man, an attorney himself, is making a quick, direct attack on health care costs by backing tort reform that will eliminate one of the greatest inefficiencies in the economics of health care. And to address the growing gap between the most highly paid workers in our society and the rest, Mr. Obama has announced major investments in education, from early childhood to universities, to improve the quality and access for all. Education, he argues, is the best way to help those who have been displaced in the process of globalization.

This is change I can believe in!

Every four years we get to dream again. Wouldn't it be nice this time if we didn't have to wake up"

The Problem of Scarcity

A Short, Wise Quote

Tuesday, November 4, 2008

The Rich and the Poor

Sunday, November 2, 2008

Tax Credits vs. Real Tax Cuts

"We've heard a lot this month about how Sen. Barack Obama's tax plans would affect Joe the Plumber -- the Ohio man who recently asked the Democratic nominee whether Obama planned to raise his taxes. Opponents of Obama seized on the incident to argue that his middle-class tax cuts are a scam. Some have even claimed that he has proposed tax increases for people with incomes as low as $32,000. Obama's supporters responded that the tax cuts are real (and noted that Joe is not a licensed plumber). The entire episode has only added to the confusion over what Obama is proposing for middle-class taxes.

How should an honest fiscal conservative see the situation? For those making less than roughly $200,000 ($250,000 for couples), Obama would not only make President Bush's tax cuts permanent but would also offer an array of new tax credits. Nobody should deny this.

To be sure, these "tax cuts" contain some sleight of hand. More than $400 billion of the money over the next 10 years would take the form of refundable tax credits paid in cash to people who already pay no federal income tax. It would be more accurate to refer to these cash outlays as cuts in payroll tax or -- even more accurately -- as transfer payments. Regardless of what the credits are called, though, they would put more money in the pockets of some American families. That sounds great in these tough economic times. Who can be against a boost to spending power and consumption?

We can. While a few of Obama's proposals may be sensible, the overall package would be bad for the economy. Unlike rate cuts for high incomes or reductions in investment taxes, most of Obama's proposed tax cuts would do little to reduce the tax penalty on work and saving. For some households, the penalty on work and saving would even increase because the new tax credits would be phased out as income rises. These proposals wouldn't deliver the economic growth that incentive-based tax cuts would.

Furthermore, there is no free lunch. Obama's middle-class tax relief would have to be paid for, either now or later. Middle-class tax cuts might make sense if they were paid for by spending cuts, but that is not Obama's plan. Like his opponent, Obama points to vague savings from reducing waste, the kind of savings that never seem to materialize. He also hopes to reap savings by accelerating our redeployment from Iraq, a project with an uncertain fiscal impact. At the same time, he proposes a wave of new spending on health-care, education, energy and infrastructure programs and declares his opposition to reforms that would reduce the growth of Social Security and other entitlement benefits.

So where would the money come from for the tax cuts and new spending? Largely from raising other taxes: the ones that have the biggest impact on economic growth. Obama would let key parts of the Bush tax cuts expire, causing the top tax rate on ordinary income to go back to 39.6 percent, up from 35 percent today. The capital gains and dividend tax rates would rise to 20 percent from today's 15 percent. Obama might also impose Social Security tax at a rate of up to 4 percent on wages and self-employment income above $250,000, starting in 2019.

These tax increases are not as bad as some Obama statements during the Democratic primaries suggested they would be, and they fall well short of what some of his conservative critics claim. For example, Obama does not propose to tax dividends at 40 percent or to impose the full 12.4 percent Social Security tax on high earners.

His real proposals, however, would still be plenty damaging. If rewards for America's entrepreneurs and firms are reduced through higher marginal tax rates, their incentives to earn, invest and create jobs will be diminished. Americans will have less incentive to save, and firms will have less incentive to pay dividends. Tax avoidance will become more profitable. A smaller capital stock will mean a less productive economy and lower wages for middle-class and other workers. These disincentive effects also mean that the revenue gain is likely to be smaller than Obama envisions.

In sum, Obama may very well give Joe the Plumber a tax break, but only if Joe does not become too successful. Obama is offering real tax favors for the middle class, but not real benefits for the economy."

Drug Companies and Innovation

Saturday, November 1, 2008

Vernon Smith on Obama

A letter in the Wall Street Journal from Nobel Prize winning economist Vernon Smith:

I think the answer to Alan Reynolds's excellent question and article ("How's Obama Going to Raise $4.3 Trillion?," op-ed, Oct. 24) is that Barack Obama is not going to raise $4.3 trillion, and he is not going to perform on his rhetoric. He excels as a rhetorician -- common to both the great and the least of past presidents -- but performance cannot run on that fuel. Inevitably, I think his luster will fade even with his most ardent supporters as that reality sets in. We also have seen luster fade time after time with Republican presidents. The rhetoric of a smaller and less invasive government always leads to king-size performance disappointments. This weakness is as central to the reality of our political economy as are its strengths. With all its foibles, its strengths become transparent when you compare it, not with our various idealizations, but with the litter of human experiments in political economy that have delivered far more suffering and murder than human betterment to the citizens of those economies.

Of course it is entirely likely that Mr. Obama will succeed in going for higher business, capital gains and income taxes, but it is an economic illusion to think for a minute that this will benefit the poor. All our wars on poverty have been lost by failing to help the poor help themselves. Higher business taxes, which ultimately can only be paid by individuals anyway, will simply export more economic activity to the world economy. Higher capital gains and income taxes will primarily reduce savings and investment at the expense of greater future productivity, which is at the heart of cross-generational reductions in poverty. A dozen countries, including the third largest economy, already have zero taxes on capital gains, and eight of them score high on the Economic Freedom Index and high in gross domestic product per capita.

I favor making all individual savings and direct investments deductible from income for tax purposes. In that world there would be no need to make any distinction between ordinary income and capital gains. By adding a negative feature to such a net consumption tax, the poor would not only receive redistribution benefit, but have an incentive to save and accumulate capital. Some poor will see this as an opportunity to help themselves.

Vernon L. Smith

Friday, October 31, 2008

Once Again, the Deregulation Myth Taken Down

A Little Obama Preview

"Obama's answers...made it crystal-clear that he sees taxation as a tool not only to pay for government, but as a tool to reassign the wealth of individual Americans directly to other individual Americans as government sees fit. If he doesn't believe in trickle-down economics, fine. But having government decide precisely how full each American's glass should be -- and them making the necessary adjustments -- would be a whole new ballgame."

And this, from the Denver Post:

"You know, once upon a time, the stated purpose of taxation was to fund public needs -- such as schools and roads -- assist those who could not help themselves, defend our security and freedom, and yes, occasionally offer bailouts to sleazy fat cats.

Obama is the first major presidential candidate in memory to assert that taxation's principal purpose should be redistribution.

The proposition that government should take one group's lawfully earned profits and hand them to another group -- not a collection of destitute or impaired Americans, mind you, but a still-vibrant middle class -- is the foundational premise of Obama's fiscal policy.

It was Joe Biden who said (not long ago, when he still was permitted to speak in public), "We want to take money and put it back in the pocket of middle-class people." The only entity that "takes" money from the middle class -- or any class for that matter -- is the Internal Revenue Service. Other than that, there is nothing to give back."

Thursday, October 30, 2008

The Stagnating Middle Class?

However, in this article, Steve Chapman points out some of the flaws in this prognosis. To me, the most important point that many seem to miss is that compensation includes much more than wages, so measuring wages alone gives skewed results about compensation changes.

Wednesday, October 29, 2008

McCain's Health Insurance Tax Credit

Tuesday, October 28, 2008

Budget Realities

Obama In His Own Words

Obama certainly wants change, but do we really want to abandon the vision of the Founding Fathers and move to one where the government has a more active role in "redistributive change"? I know I don't.

Friday, October 24, 2008

A Comprehensive Policy Review of the Bailout

Thursday, October 23, 2008

Get Ready '08

"I think at this point there needs to be a focus on an immediate increase in spending and I think this is a time when deficit fear has to take a second seat . . . I believe later on there should be tax increases. Speaking personally, I think there are a lot of very rich people out there whom we can tax at a point down the road and recover some of the money." -- Barney Frank, October 20, 2008

Apparently Barney Frank believes that he is a joint owner on all the bank accounts owned by these "rich people," and he can just withdraw however much money he wants to fund his new government projects.

Even beyond this objection, Barney Frank appears to be stuck in the mindset of 1960's economic policy-- in a recession? Give more money to the government to spend! Sure, we have been accumulating huge deficits over the past few years with no apparent surge in economic growth, but why let failure stop you from continuing the course?

Monday, October 20, 2008

A Crisis of Distorted Markets

Financial Times: McCain is no salesman on tax proposals

So much has gone wrong for John McCain that it is surprising he is not further behind in the polls. He has been a victim of circumstances and his own bad judgment. Some of his errors, however, are more perplexing than others. How is it, for example, that Mr McCain has been so thoroughly outmanoeuvred on tax policy?

Both candidates have offered complex tax proposals. Proliferating alternative baselines (with or without the extension of the Bush tax cuts, with or without a “patch” for the alternative minimum tax, and so forth) deepen the confusion. Unable to fathom the details, voters are left to weigh the competing slogans. Mr Obama promises to cut taxes for 95 per cent of working families. Mr McCain says the rich need a tax cut, too. Guess who wins that argument.

Here is a fact you might not have noticed. It certainly seems to have slipped by most Americans. The typical US household would get a bigger tax cut under Mr McCain’s proposals than under Mr Obama’s. I know a few politicians who could do something with that.

Broadly speaking, Mr McCain proposes to leave the Bush tax cuts in place. Mr Obama proposes a big increase in taxes on people earning more than $250,000 (€187,000, £145,000) a year, in order to cut taxes and increase subsidies at the bottom; for the middle, he too would mostly keep the Bush tax code. Middle-income households do come out slightly ahead under the Obama plan – but only if you leave out the effect of Mr McCain’s healthcare proposal. The question is, why would you do that?

Mr McCain wants to abolish the tax-break for employer-provided healthcare and replace it with a refundable $5,000 credit. Mr Obama says that a family health plan might cost $12,000 a year – leaving families who buy their own policy $7,000 worse off. This is incorrect. So far as I know, Mr McCain has never taken the trouble to explain why.

Suppose a family currently has a $12,000 policy provided by an employer. Under the McCain proposal, instead of attracting relief as at present, this benefit would be taxed as ordinary employment income – but the extra tax paid would be more than offset by the new $5,000 credit. In the first analysis, nothing changes so far as employers are concerned: all the action is on the employee’s pay cheque. The policy delivers a net tax cut to middle-income households and is enough to make the McCain tax plan on average a better overall deal for them than the Obama plan.

Odd, don’t you think, that the McCain campaign should think this unworthy of emphasis?

It is true that the healthcare credit would have additional longer-term consequences – some desirable, some not. Since the credit is fixed in value, taxpayers would have an incentive to choose cheaper plans (with bigger deductibles and co-payments). That is a good consequence: it would exert some downward pressure on healthcare inflation. Less desirable is that healthy young workers might prefer to opt out of employer-provided plans in return for more pay, because they could find cheaper cover for themselves elsewhere. This would make the employer’s pool of employees riskier, and drive up premiums. It might encourage some employers to stop providing cover altogether and that would leave riskier workers at a disadvantage.

A defect of the McCain plan is that it fails to combine the tax incentive to economise with adequate measures to assure coverage. Its direct effect on middle-income households, though, is still to cut taxes by more than Mr Obama’s plan.

As well as failing to drive this home, Mr McCain has only weakly resisted his opponent’s notion that “wealthy companies” can afford to pay more. Business taxes, in the end, are paid by people – in lower wages, higher prices and lower dividends in their 401k plans. The point is not just that US corporate taxes are high by international standards and that this discourages investment and employment but that the burden eventually falls on ordinary Americans. Perhaps Mr McCain’s recent emphasis on corporate greed makes it difficult for him to point this out.

When Mr McCain misrepresents Mr Obama, he cannot even do it plausibly. Mr Obama is indeed planning to cut taxes for 95 per cent of working families. Rather than saying, “No he isn’t”, Mr McCain could have said: “Look at what his changes do to marginal tax rates, at the bottom of the income scale (as benefits are phased out), as well as at the top.” Rather than saying, “He wants to raise your taxes,” he could have said, “His spending plans will force him to raise your taxes.”

Joe the Plumber featured prominently in last week’s presidential debate. Mr McCain said that Joe wanted to set up in business but was worried about the taxes on his income of more than $250,000 a year. Mr Obama was effective: he dismissed Joe as a rare case. Not many plumbers make that much; 98 per cent of small businesses make less. (Never mind that the 2 per cent account for a disproportionate share of new jobs.) It makes sense, Mr Obama said, to “spread the wealth around”.

Even in 2008 that is an un-American idea, as Mr McCain did point out. But the degree to which he has yielded on taxes is nonetheless surprising. Given the cost of the financial rescue, this whole debate may be moot. The fact remains, he is offering middle-income families – not just the rich – a bigger tax cut than Mr Obama, and they don’t appear to know it.

Sunday, October 19, 2008

Some Quick Links

- Is Obama's tax plan socialistic? McCain says so here. Charges of socialism may be hyperbole, but consider this: I define a tax cut as meaning that you get to keep more of your own money. Obama, on the other hand, sends everybody (except those making over $200,000) a check, including those who do not pay any income taxes.

- The Wall Street Journal, in another piece here, explores the folly of blaming the financial crisis on deregulation.

- McCain wants to end employment-based health insurance? I certainly hope so. In this article Jeff Jacoby explains here some of the faults of the current system. I hope at some point soon to discuss health policy in more depth.

Wednesday, October 15, 2008

The Folly of Setting Pay Limits

In an ideal world, CEOs would be looking out for the long-term interests of the shareholders. This means maximizing long-run profits. However, what CEOs are actually interested in is how well they personally do. The job of boardrooms is to design incentive schemes that align the personal interests of the CEO with the interests of the stock holders. I would say that in many well-publicized instances, they have failed. This is an example of a problem in economics called the principal-agent problem.

There may indeed be effective policy reforms which could mitigate the principal-agent problem in the market for CEOs. Setting arbitrary pay limits, however, is no solution. This very clear and intelligent article in the Financial Times explains why.

Tuesday, October 14, 2008

The Paul Revere of the Fannie/Freddie Debacle

Monday, October 13, 2008

Class Warfare

Thursday, October 9, 2008

Obama's "Tax Cuts"

Does that mean that Obama is lying? No, but it means he is packaging something else with a false label. That something else is taking money from some taxpayers and giving it to everyone else. I'll leave it to The Economist, in this article, to clarify what I mean:

"Fact-checkers quibble that, according to his written plans, he really means 95% of families with children, not 95% of Americans. But his real sleight-of-hand is to count handouts administered through the tax code as “tax cuts”. You might think that a tax cut means keeping more of what you earn. The way Mr Obama uses the phrase, however, it can also mean being given a chunk of money that someone else has earned. That is how he is able to offer “tax cuts” to “95% of Americans” when about a third of American households already pay no federal income tax."

Sunday, October 5, 2008

What Is The Purpose Of The Financial Rescue Bill?

"In this regard, the Federal Reserve supports the Treasury's proposal to buy illiquid assets from financial institutions. Purchasing impaired assets will create liquidity and promote price discovery in the markets for these assets, while reducing investor uncertainty about the current value and prospects of financial institutions."

Saturday, October 4, 2008

One More Swing at the Piñata

Politics at its Worst

What a pile of crap and lies in place of a legitimate and intellectually honest argument...nothing else to say.

Note to Congress: You Were Wrong, Now Admit It

The "Free Market" Isn't Dead

The problem with this argument is that the completely untamed, unregulated, unwieldy "free market" hasn't been around in the financial sector for a long, long time. The government has for several decades played a major role in designing the rules, incentives, and institutions in financial markets, so it only makes sense that we look at the government's role in creating this mess, not just the supposedly new-found greed of Wall Street CEO's.

Robert Bruner, dean of UVA's business school, explains here.

Friday, October 3, 2008

Economists Debate How To Fix The Mess

Also: Russell Roberts, in another article, discusses the government's very large role in causing and precipitating this crisis. A failure of the last 8 years of deregulation? That's a convenient story, except that there has been no major deregulation of financial markets during that time.

Wondering About The Financial Rescue Bill?

The Bailout: An Owner's Manual

Sunday, September 28, 2008

Saturday, September 27, 2008

When $700 Billion Isn't $700 Billion

I have refrained from coming out for or against the "bailout" because the details have yet to be released. I tend to think that the financial situation is critical, and that effective legislation should be passed, and quickly. The following is some testimony from Peter Orszag, the head of the Congressional Budget Office, talking about the main gist of Paulson's proposal, its likely actual cost, and some alternative proposals. The key here: the $700 billion "bailout" is not likely to cost anywhere near $700 billion, assuming it even gets passed.

Paulson wants the government to purchase upwards of $700 billion of mortgage-backed assets that banks are unable to unload, because no market exists for these assets anymore. The mortgages themselves do have actual value, as the vast majority of them are likely to be paid off, but due to the situation in the financial markets (the causes of which I have discussed in previous posts), the market for these assets has shut down, which is equivalent to saying that these assets are being valued at nearly nothing. Paulson's plan calls for something probably like a reverse auction, which would determine the value of the mortgages and how much the government would pay for them, and then in theory the financial markets would stabilize, after which point the government would sell the assets back and recoup some, all, or more than all of the initial $700 billion.

Go here for the CBO testimony.

Distorting History

Thursday, September 25, 2008

Hindsight Is Always 20/20, But Foresight Can Be 20/20 Too

Fannie Mae Eases Credit To Aid Mortgage Lending

Published: September 30, 1999

In a move that could help increase home ownership rates among minorities and low-income consumers, the Fannie Mae Corporation is easing the credit requirements on loans that it will purchase from banks and other lenders.

The action, which will begin as a pilot program involving 24 banks in 15 markets -- including the New York metropolitan region -- will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans. Fannie Mae officials say they hope to make it a nationwide program by next spring.

Fannie Mae, the nation's biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its phenomenal growth in profits.

In addition, banks, thrift institutions and mortgage companies have been pressing Fannie Mae to help them make more loans to so-called subprime borrowers. These borrowers whose incomes, credit ratings and savings are not good enough to qualify for conventional loans, can only get loans from finance companies that charge much higher interest rates -- anywhere from three to four percentage points higher than conventional loans.

''Fannie Mae has expanded home ownership for millions of families in the 1990's by reducing down payment requirements,'' said Franklin D. Raines, Fannie Mae's chairman and chief executive officer. ''Yet there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market''

Demographic information on these borrowers is sketchy. But at least one study indicates that 18 percent of the loans in the subprime market went to black borrowers, compared to 5 per cent of loans in the conventional loan market.

In moving, even tentatively, into this new area of lending, Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980's.

''From the perspective of many people, including me, this is another thrift industry growing up around us,'' said Peter Wallison a resident fellow at the American Enterprise Institute. ''If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry.''

Under Fannie Mae's pilot program, consumers who qualify can secure a mortgage with an interest rate one percentage point above that of a conventional, 30-year fixed rate mortgage of less than $240,000 -- a rate that currently averages about 7.76 per cent. If the borrower makes his or her monthly payments on time for two years, the one percentage point premium is dropped.

Fannie Mae, the nation's biggest underwriter of home mortgages, does not lend money directly to consumers. Instead, it purchases loans that banks make on what is called the secondary market. By expanding the type of loans that it will buy, Fannie Mae is hoping to spur banks to make more loans to people with less-than-stellar credit ratings.

Fannie Mae officials stress that the new mortgages will be extended to all potential borrowers who can qualify for a mortgage. But they add that the move is intended in part to increase the number of minority and low income home owners who tend to have worse credit ratings than non-Hispanic whites.

Home ownership has, in fact, exploded among minorities during the economic boom of the 1990's. The number of mortgages extended to Hispanic applicants jumped by 87.2 per cent from 1993 to 1998, according to Harvard University's Joint Center for Housing Studies. During that same period the number of African Americans who got mortgages to buy a home increased by 71.9 per cent and the number of Asian Americans by 46.3 per cent.

In contrast, the number of non-Hispanic whites who received loans for homes increased by 31.2 per cent.

Despite these gains, home ownership rates for minorities continue to lag behind non-Hispanic whites, in part because blacks and Hispanics in particular tend to have on average worse credit ratings.

In July, the Department of Housing and Urban Development proposed that by the year 2001, 50 percent of Fannie Mae's and Freddie Mac's portfolio be made up of loans to low and moderate-income borrowers. Last year, 44 percent of the loans Fannie Mae purchased were from these groups.

The change in policy also comes at the same time that HUD is investigating allegations of racial discrimination in the automated underwriting systems used by Fannie Mae and Freddie Mac to determine the credit-worthiness of credit applicants.

Monday, September 22, 2008

A Mortgage Fable

Over the past couple of weeks we have been fed a story by certain elements of the media and the DC establishment that places the entire "blame" for the current financial crisis on private market forces. They claim that if we only had had more regulation and government intervention, that these problems would have never occurred. Alas, reality is more complex than this fable would have us believe.

Friday, September 19, 2008

How to Save the Financial System

More Regulation or More Relevant Regulation?

"More regulation will harm, not help, recovery" by Gerard Baker

I especially like this line: "But it is more likely to require not aggressive government intervention, but simply the insistence on better provision of information to avoid the chaos created in the past year because investors didn't have a clue about the quality of many of the assets that they held."

"The Post-Lehman World" by David Brooks

As far as I can tell, there are three main problems that have been driving the crisis: 1) asymmetric information and a lack of transparency in financial markets, 2) implicit guarantees by the government for companies (including Fannie Mae and Freddie Mac) which were supposedly "too big to fail," and 3) ineffective regulation (this means too much regulation where there should be less, too little regulation where there should be more, and also just plain bad regulations).

The government implicitly guaranteed that Fannie Mae and Freddie Mac would not be allowed to fail, and not only did it fail to oversee how Fannie Mae and Freddie Mac were buying up tenuous mortgages (including mortgages for which the borrower did not have to give proof of income), but the government actually encouraged, through various laws passed in the recent decade or so, Fannie and Freddie to target less credit-worthy people to get loans. Then Fannie and Freddie sold these mortgages to other banks, where nobody in the transaction had any real idea about the fundamentals of the asset they were buying. How likely was the buyer to make payments? How likely was the buyer to default? Nobody had any idea, because this private information was not made known to all parties involved, or more specifically, the information was asymmetric. These investment firms then created assets which were based on these mortgages, and sold these assets to yet other parties, and soon we had layers of assets being bought and sold, all based on the original tenuous mortgage, and nobody having any idea how much risk they were taking on. In fact, not only did they not know how much risk they were taking on, but they did not even care (enough), because they believed (correctly, as we now know) that the government would bail them out if the risk became reality.

In short, the government encouraged lending institutions to give out loans to people who were not credit-worthy, implicitly guaranteed that these institutions would not be allowed to fail, and failed to ensure that financial markets were transparent, meaning that most players did not know how much risk they were taking on when they purchased assets based off of these bad mortgages.

Does that mean we have a lack of regulation? Yes and no. Yes, in the sense that we need better accounting rules and more transparency in financial markets. No, because regulations are also what encouraged these bad mortgages to be given out, and also because existing regulations helped shape the accounting framework that we have now, which has clearly failed.

Addendum: Blaming the crisis on greed is a lame critique. Businesses, entrepreneurs, and regular citizens always try to make money and profits, so claiming that sometimes they are more greedy than other times is just plain wrong, and not the cause of financial panics.

Sunday, September 14, 2008

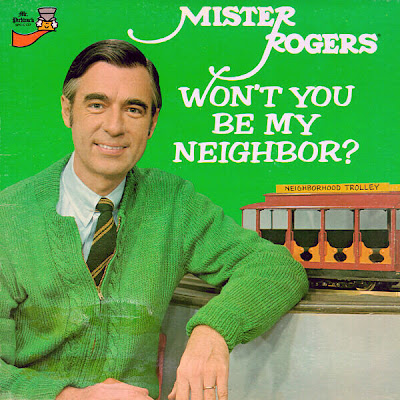

Oh Won't You Be My Neighbor?