Sunday, September 28, 2008

Saturday, September 27, 2008

When $700 Billion Isn't $700 Billion

I have refrained from coming out for or against the "bailout" because the details have yet to be released. I tend to think that the financial situation is critical, and that effective legislation should be passed, and quickly. The following is some testimony from Peter Orszag, the head of the Congressional Budget Office, talking about the main gist of Paulson's proposal, its likely actual cost, and some alternative proposals. The key here: the $700 billion "bailout" is not likely to cost anywhere near $700 billion, assuming it even gets passed.

Paulson wants the government to purchase upwards of $700 billion of mortgage-backed assets that banks are unable to unload, because no market exists for these assets anymore. The mortgages themselves do have actual value, as the vast majority of them are likely to be paid off, but due to the situation in the financial markets (the causes of which I have discussed in previous posts), the market for these assets has shut down, which is equivalent to saying that these assets are being valued at nearly nothing. Paulson's plan calls for something probably like a reverse auction, which would determine the value of the mortgages and how much the government would pay for them, and then in theory the financial markets would stabilize, after which point the government would sell the assets back and recoup some, all, or more than all of the initial $700 billion.

Go here for the CBO testimony.

Distorting History

Thursday, September 25, 2008

Hindsight Is Always 20/20, But Foresight Can Be 20/20 Too

Fannie Mae Eases Credit To Aid Mortgage Lending

Published: September 30, 1999

In a move that could help increase home ownership rates among minorities and low-income consumers, the Fannie Mae Corporation is easing the credit requirements on loans that it will purchase from banks and other lenders.

The action, which will begin as a pilot program involving 24 banks in 15 markets -- including the New York metropolitan region -- will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans. Fannie Mae officials say they hope to make it a nationwide program by next spring.

Fannie Mae, the nation's biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its phenomenal growth in profits.

In addition, banks, thrift institutions and mortgage companies have been pressing Fannie Mae to help them make more loans to so-called subprime borrowers. These borrowers whose incomes, credit ratings and savings are not good enough to qualify for conventional loans, can only get loans from finance companies that charge much higher interest rates -- anywhere from three to four percentage points higher than conventional loans.

''Fannie Mae has expanded home ownership for millions of families in the 1990's by reducing down payment requirements,'' said Franklin D. Raines, Fannie Mae's chairman and chief executive officer. ''Yet there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market''

Demographic information on these borrowers is sketchy. But at least one study indicates that 18 percent of the loans in the subprime market went to black borrowers, compared to 5 per cent of loans in the conventional loan market.

In moving, even tentatively, into this new area of lending, Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980's.

''From the perspective of many people, including me, this is another thrift industry growing up around us,'' said Peter Wallison a resident fellow at the American Enterprise Institute. ''If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry.''

Under Fannie Mae's pilot program, consumers who qualify can secure a mortgage with an interest rate one percentage point above that of a conventional, 30-year fixed rate mortgage of less than $240,000 -- a rate that currently averages about 7.76 per cent. If the borrower makes his or her monthly payments on time for two years, the one percentage point premium is dropped.

Fannie Mae, the nation's biggest underwriter of home mortgages, does not lend money directly to consumers. Instead, it purchases loans that banks make on what is called the secondary market. By expanding the type of loans that it will buy, Fannie Mae is hoping to spur banks to make more loans to people with less-than-stellar credit ratings.

Fannie Mae officials stress that the new mortgages will be extended to all potential borrowers who can qualify for a mortgage. But they add that the move is intended in part to increase the number of minority and low income home owners who tend to have worse credit ratings than non-Hispanic whites.

Home ownership has, in fact, exploded among minorities during the economic boom of the 1990's. The number of mortgages extended to Hispanic applicants jumped by 87.2 per cent from 1993 to 1998, according to Harvard University's Joint Center for Housing Studies. During that same period the number of African Americans who got mortgages to buy a home increased by 71.9 per cent and the number of Asian Americans by 46.3 per cent.

In contrast, the number of non-Hispanic whites who received loans for homes increased by 31.2 per cent.

Despite these gains, home ownership rates for minorities continue to lag behind non-Hispanic whites, in part because blacks and Hispanics in particular tend to have on average worse credit ratings.

In July, the Department of Housing and Urban Development proposed that by the year 2001, 50 percent of Fannie Mae's and Freddie Mac's portfolio be made up of loans to low and moderate-income borrowers. Last year, 44 percent of the loans Fannie Mae purchased were from these groups.

The change in policy also comes at the same time that HUD is investigating allegations of racial discrimination in the automated underwriting systems used by Fannie Mae and Freddie Mac to determine the credit-worthiness of credit applicants.

Monday, September 22, 2008

A Mortgage Fable

Over the past couple of weeks we have been fed a story by certain elements of the media and the DC establishment that places the entire "blame" for the current financial crisis on private market forces. They claim that if we only had had more regulation and government intervention, that these problems would have never occurred. Alas, reality is more complex than this fable would have us believe.

Friday, September 19, 2008

How to Save the Financial System

More Regulation or More Relevant Regulation?

"More regulation will harm, not help, recovery" by Gerard Baker

I especially like this line: "But it is more likely to require not aggressive government intervention, but simply the insistence on better provision of information to avoid the chaos created in the past year because investors didn't have a clue about the quality of many of the assets that they held."

"The Post-Lehman World" by David Brooks

As far as I can tell, there are three main problems that have been driving the crisis: 1) asymmetric information and a lack of transparency in financial markets, 2) implicit guarantees by the government for companies (including Fannie Mae and Freddie Mac) which were supposedly "too big to fail," and 3) ineffective regulation (this means too much regulation where there should be less, too little regulation where there should be more, and also just plain bad regulations).

The government implicitly guaranteed that Fannie Mae and Freddie Mac would not be allowed to fail, and not only did it fail to oversee how Fannie Mae and Freddie Mac were buying up tenuous mortgages (including mortgages for which the borrower did not have to give proof of income), but the government actually encouraged, through various laws passed in the recent decade or so, Fannie and Freddie to target less credit-worthy people to get loans. Then Fannie and Freddie sold these mortgages to other banks, where nobody in the transaction had any real idea about the fundamentals of the asset they were buying. How likely was the buyer to make payments? How likely was the buyer to default? Nobody had any idea, because this private information was not made known to all parties involved, or more specifically, the information was asymmetric. These investment firms then created assets which were based on these mortgages, and sold these assets to yet other parties, and soon we had layers of assets being bought and sold, all based on the original tenuous mortgage, and nobody having any idea how much risk they were taking on. In fact, not only did they not know how much risk they were taking on, but they did not even care (enough), because they believed (correctly, as we now know) that the government would bail them out if the risk became reality.

In short, the government encouraged lending institutions to give out loans to people who were not credit-worthy, implicitly guaranteed that these institutions would not be allowed to fail, and failed to ensure that financial markets were transparent, meaning that most players did not know how much risk they were taking on when they purchased assets based off of these bad mortgages.

Does that mean we have a lack of regulation? Yes and no. Yes, in the sense that we need better accounting rules and more transparency in financial markets. No, because regulations are also what encouraged these bad mortgages to be given out, and also because existing regulations helped shape the accounting framework that we have now, which has clearly failed.

Addendum: Blaming the crisis on greed is a lame critique. Businesses, entrepreneurs, and regular citizens always try to make money and profits, so claiming that sometimes they are more greedy than other times is just plain wrong, and not the cause of financial panics.

Sunday, September 14, 2008

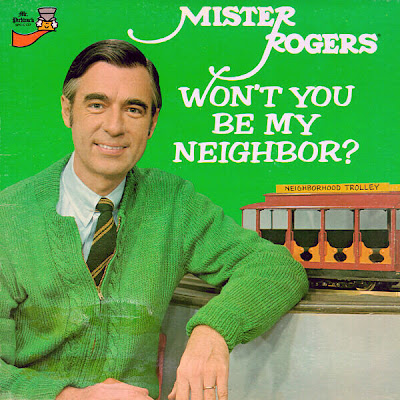

Oh Won't You Be My Neighbor?

Saturday, September 6, 2008

Some Alternative Obama Slogans

Friday, September 5, 2008

McCain's Speech: The Maverick Returns

Tuesday, September 2, 2008

McCain vs. Obama: Taxes Edition

Martin Feldstein, Professor of Economics at Harvard and former chair of the National Bureau of Economic Research, and John Taylor, Professor of Economics at Stanford, give their take on McCain's tax plans and how they compare to Obama's. To read, go here.